will child tax credit monthly payments continue in 2022

For 2022 that amount reverted to 2000 per child dependent 16 and younger. Now even before those monthly child tax credit advances run out the final two payments come on Nov.

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Parents E-File to Get the Credits Deductions You Deserve.

. The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021. Those who opted out of all. Half of the credit -.

The maximum child tax credit amount will decrease in 2022. Those who opted out of all. Those who opted out of all.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Those who opted out of all. As it stands right now child tax credit payments wont be renewed this year.

If parents opted out of some payments but not all they can expect something between 1500. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The plan was always for another payment to be made in April.

Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18. Those who opted out of all. Those who opted out of all.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents of children age 17 and under got a 1000 bump in their child tax credit for 2021 half of which was paid in monthly installments.

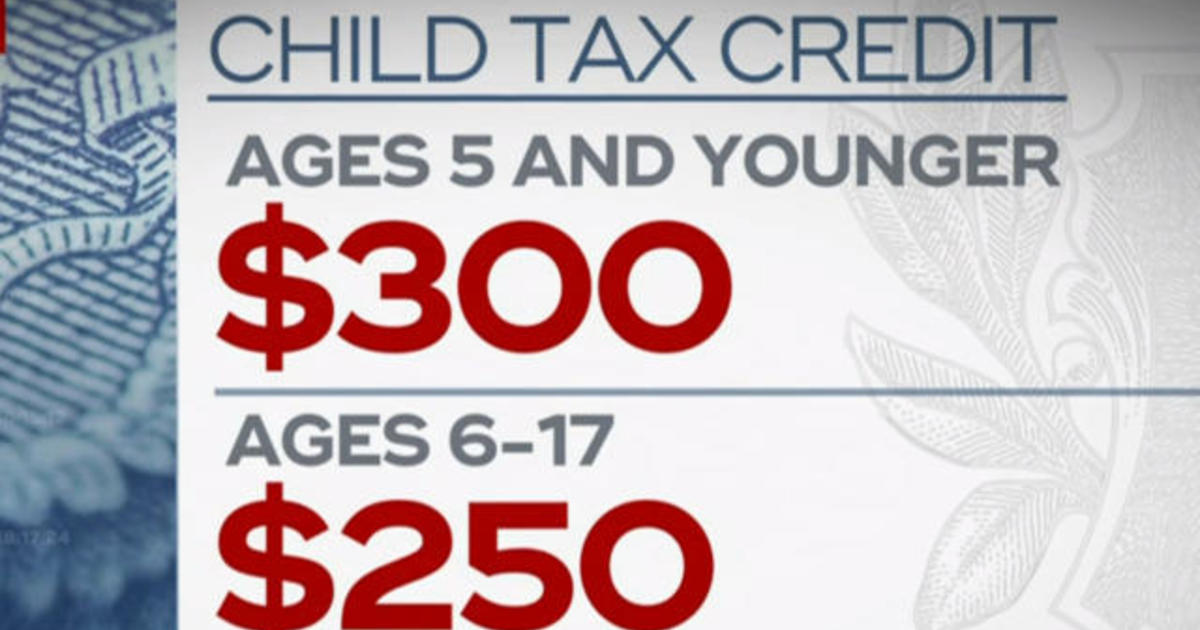

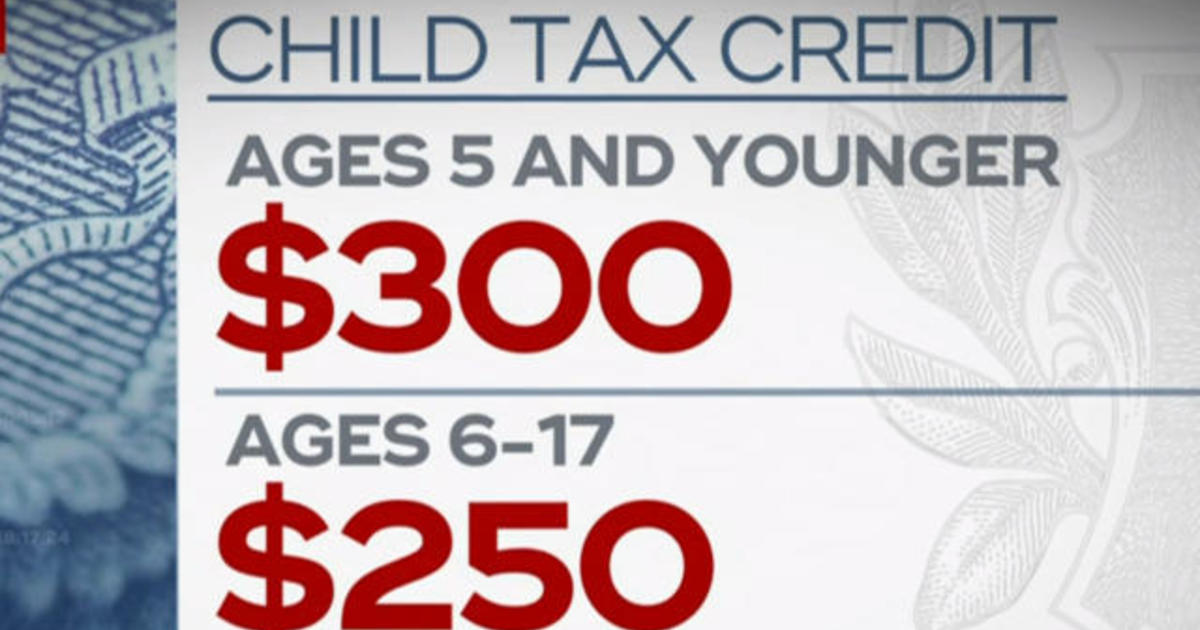

The last of those monthly payments went out in December 2021. Eligible families will receive 300 monthly for each child under 6 and 250 per older child. This credit begins to phase down to 2000 per child once household income reaches 75000 for individuals 112500 for heads of household and 150000 for.

The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. But this may not. Eligible families will receive 300 monthly for each child under 6 and 250 per older child.

For children under 6 the amount jumped to 3600. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17.

The plan raised the existing child tax credit from 2000 to up to 3600 per child for ages 5 and younger and 3000 for each child aged 6-17. Those who opted out of all. For 2022 that amount reverted to 2000 per child dependent 16 and younger.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. 2 days agoTue Aug 09 2022. Those who opted out of all the monthly payments can expect a 3000 or 3600.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting with the first payment on January 15 2022. We dont make judgments or prescribe specific policies.

The rebate caps at 750. 15 Democratic leaders in Congress are working to extend the benefit into 2022. See what makes us different.

That legislation increased payments for the Child Tax Credit to 3600 for eligible children under 6 and 3000. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

The short answer is NO since a funding extension for 2022 payments has not yet been approved by Congress. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Stimulus Update Here S Why Some Families Will Receive 3 600 Child Tax Credit Payment In 2022 Silive Com

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Child Tax Credit In 2022 See If You Ll Be Paid 750 From Your State Cnet

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

No More Monthly Child Tax Credits Now What

The December Child Tax Credit Payment May Be The Last

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply

Will Child Tax Credit Payments Be Extended In 2022 Money

Child Tax Credit July 2022 Who Will Receive This Payment Child Credit Updates Youtube

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger